The rise in the cost of building materials has a multiplier effect on the industry, resulting in increased housing prices.

In the years before the pandemic, the Malaysian property market has been imbalanced in terms of supply and demand, with demand outpacing supply, particularly for low-cost homes. Homeownership became unaffordable for many people after the outbreak of the pandemic due to a combination of lower income, job loss and a sluggish economy.

According to Khazanah Research Institute’s (KRI) most recent housing report, “little has improved to make homes affordable between 2002 and 2016.”

Background research for the National Housing Policy (2018–2025) revealed that prices for homes have continued to grow, with the market median house price reaching RM188,000 in 2016, up from RM165,000 just two years prior. Newly launched housing units priced below RM200,000 accounted for fewer than 20% of total units released during the same time. In Q2 2020, the average price of a house is RM427,882, doubling from the median price a decade prior.

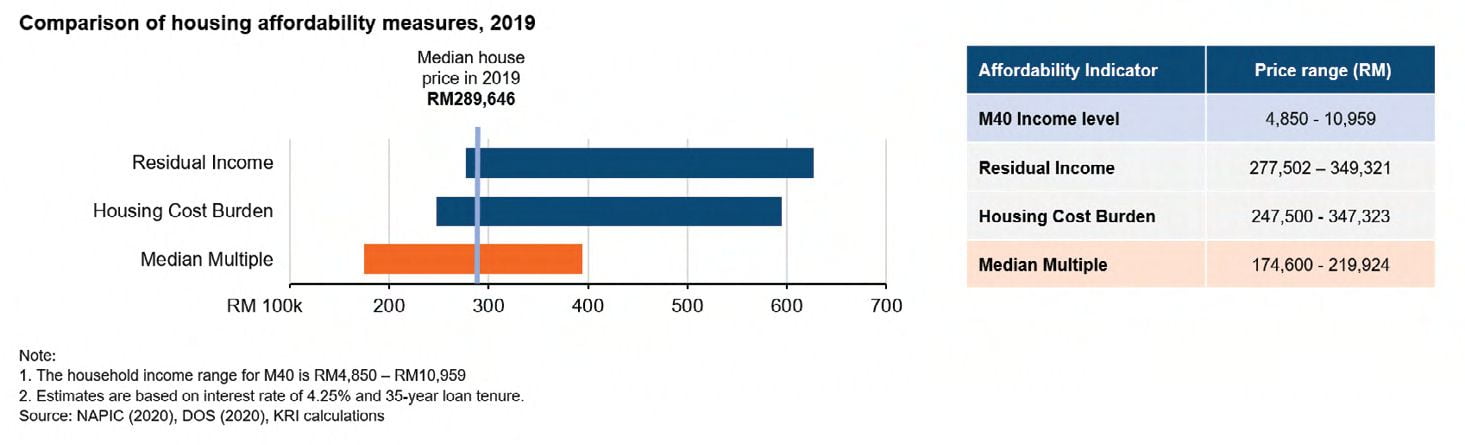

It is painfully evident that the housing supply does not match the demand. In her presentation at ICW 2021, Dr. Suraya Ismail of Khazanah Research Institute stated that in 2019, the affordable median house price for Malaysia was RM211,428 (3x median annual household income). “Yet, newly launched housing units priced below RM200k made up only 15.7% of total new launches in 2020. In contrast, houses supplied above RM500k made up 24.6% of total new launches in 2020,” she said.

Looking at Figure 2 below, the maximum price for an affordable home for the M40 under the Residual Income and Housing Cost Burden approach is 50% more expensive than the maximum price for the median multiple estimate. Most notably, when compared to the actual median house price for 2019, the price range for affordable homes under the RI and HCB skews to the right showing a glaring imbalance of housing supply and affordability.

Factors Contributing to a Drop in Affordable Housing

In his presentation at the ICW 2021 workshop, Sr. Nazir Muhamad Nor, Vice President of QS Royal Institution of Surveyors Malaysia, shared the reasons behind the reduction in affordable housing. “First, the Malaysia My Second Home (MM2H) scheme, which was designed to attract wealthy expats, resulted in a surge of building for properties priced half a million ringgits or higher,” he said.

“Second, developers shifted their focus to the higher-end market in the hopes of profiting from the nearly five-year-long property boom.”

The third main reason, said Nazir, was that developers resisted newer technologies, preferring to rely on time-consuming and labour-intensive construction methods. “For the past 10 years, a shortage of manpower supply has been cited as the primary reason for skyrocketing property prices.”

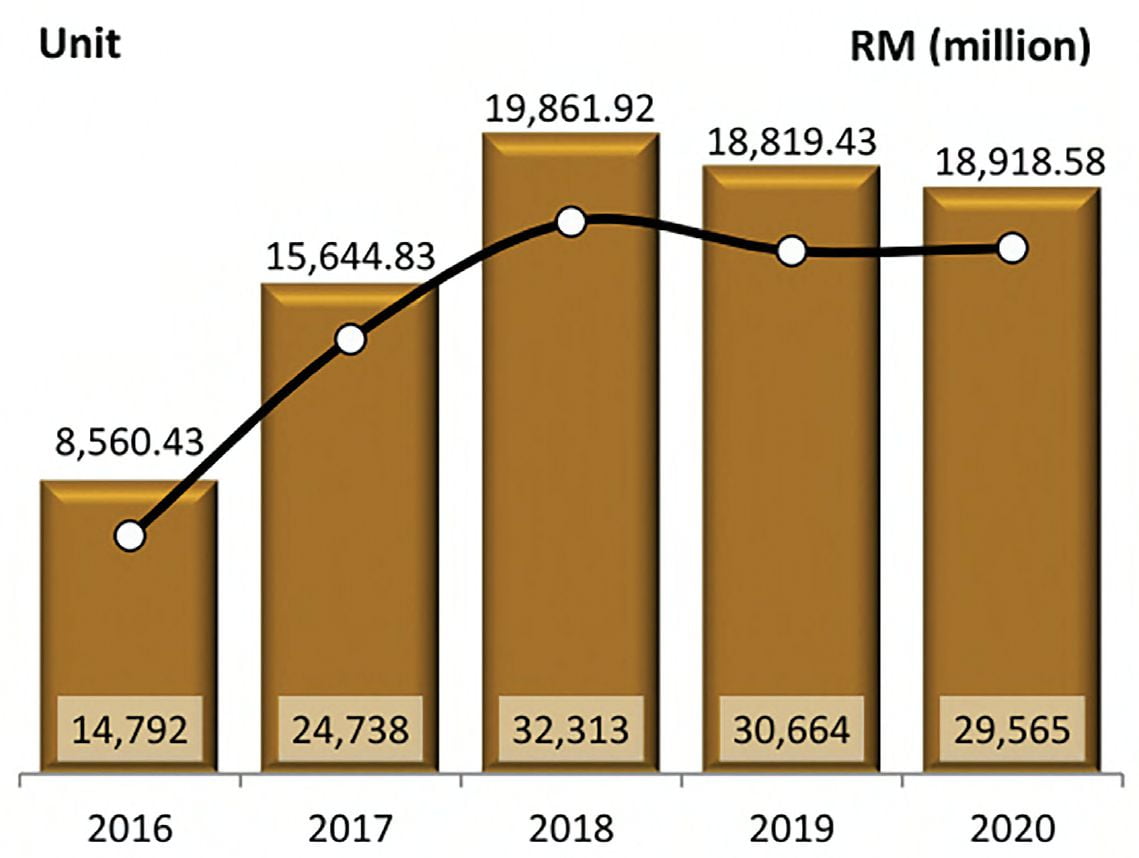

Property Overhang

The drop in affordable housing is one of the major contributing factors towards property overhang. The National Property Information Centre (NAPIC) defines overhang “as residential units which have received Certificate of Completion and Compliance (CCC) but remained unsold for more than nine months after launch”.

Another factor of property overhang could also be the oversupply of housing stocks, which has surpassed the market’s absorptivity limit. Every market has an absorptivity limit, which may be determined by examining the take-up rate of new launches at different locations.

Residential property overhang is not simply a concern for developers; it also imposes social costs on homebuyers and the community in which the overhang units are located. As a result, it is critical to address and reconsider some of the policies and mechanisms in place to solve the overhang issue, including availing more affordable housing to the masses.

House Prices & Supply Nazir added that many factors affect the cost of building a house, including land, building materials, professionals, permits, and legal fees. All these contribute to the overall house price.

The cost composition of building a house is depicted in Figure 4:

The Rising Cost of Building Materials

The rising building material costs in Malaysia is the combined result of multiple factors:

- Import restrictions on specific construction materials

- Long-term development plans

- Economic conditions and the confidence of investors

- The increase in petrol/diesel prices and electricity tariffs

- Government policies

- The imposition of a goods and services tax

- Housing and property policies such as the property gains tax, the restriction on foreign purchase on the affordable housing programme

- The interest rate (BLR)

- Supply and demand in the property market

Then there are the factors affecting residential building prices. These include the land acquisition policy and conversion process, land costs, construction materials and labour costs, enhanced security features, petrol/ diesel prices, and electricity tariffs due to the rationalisation of fuel subsidies.

Amid the pandemic, building material prices have risen in tandem with labour shortages and wage increases. These additional costs would be borne by the contractors who are responsible for their workers.

Cost increases were caused, among other factors, by factory closures during the MCO period. This hampered factory operations, especially those that manufacture building materials, and, as a result, impacted project execution

To counteract the rise in material costs, the government implemented the variation of price (VOP) facility for government projects, which was in force from 1 January to 31 December last year. Although the VOP did not apply to commercial projects, the government encouraged private clients to reimburse the cost increase.

However, as the economy recovers with more companies being allowed to operate through the National Recovery Plan, the Ministry of Works anticipates that subsequent production of materials could stabilise prices.

Implications of Building Materials Cost Increase

Nazir noted that increases in building material prices have a multiplier effect on the industry because they cause fluctuations in construction costs.

The primary cause of cost overruns is that most contractors quote prices based on projected estimates; however, prices fluctuate so quickly that the initial budget calculations become completely unrealistic. This leads to contractors’ cash flow and financial difficulties, which are either passed down to house buyers or result in project abandonment.

Other potential consequences of rising costs include project work delays, low construction worker employment rates, poor workmanship resulting from poor-quality materials, and the reluctance to adopt advanced construction technologies.

The latter consequence has a severe impact on the industry. Construction companies have a social responsibility to train their staff, maintain workers’ health and safety, and invest in continuous improvement in technology and management. However, the rise in the building materials costs have slashed profit margins and adversely affected innovations in constructions methods and material research.

Nazir surmised that a 5% rise in material price results in a 2% increase in gross development costs (GDC), a 10% increase in material price results in a 3% increase in GDC, and a 15% increase in material price results in a 5% increase in GDC.

He concluded that the increase in building materials costs would impact the overall cost of the development, which later translates to a higher cost of selling price by developers.

“However, the increase can always be checked, and developers should give a more competitive pricing and cap it at a 5% increase of the gross development price,” Nazir suggested at the conclusion of his presentation. If left unchecked, the ramifications could have a negative impact on the nation’s gross domestic product (GDP).