In the landscape of global finance, investors are increasingly prioritising sustainability and ethical business practices. Bursa Malaysia, one of the leading stock exchanges in Asia, has taken a significant step in this direction by adopting the FTSE4Good ESG Rating Index. This index is a comprehensive tool that evaluates the Environmental, Social, and Governance (ESG) practices of listed companies, providing investors with valuable insights into the sustainability performance of these entities.According to Ms Wong Hui Yin, Index & Sustainable Business, Bursa Intelligence, Bursa Malaysia during ICTC 2023, as an ongoing commitment to foster the integration of ESG practices in the business landscape, Bursa Malaysia has partnered with FTSE Russell to provide ESG scores for publicly listed Malaysian companies.

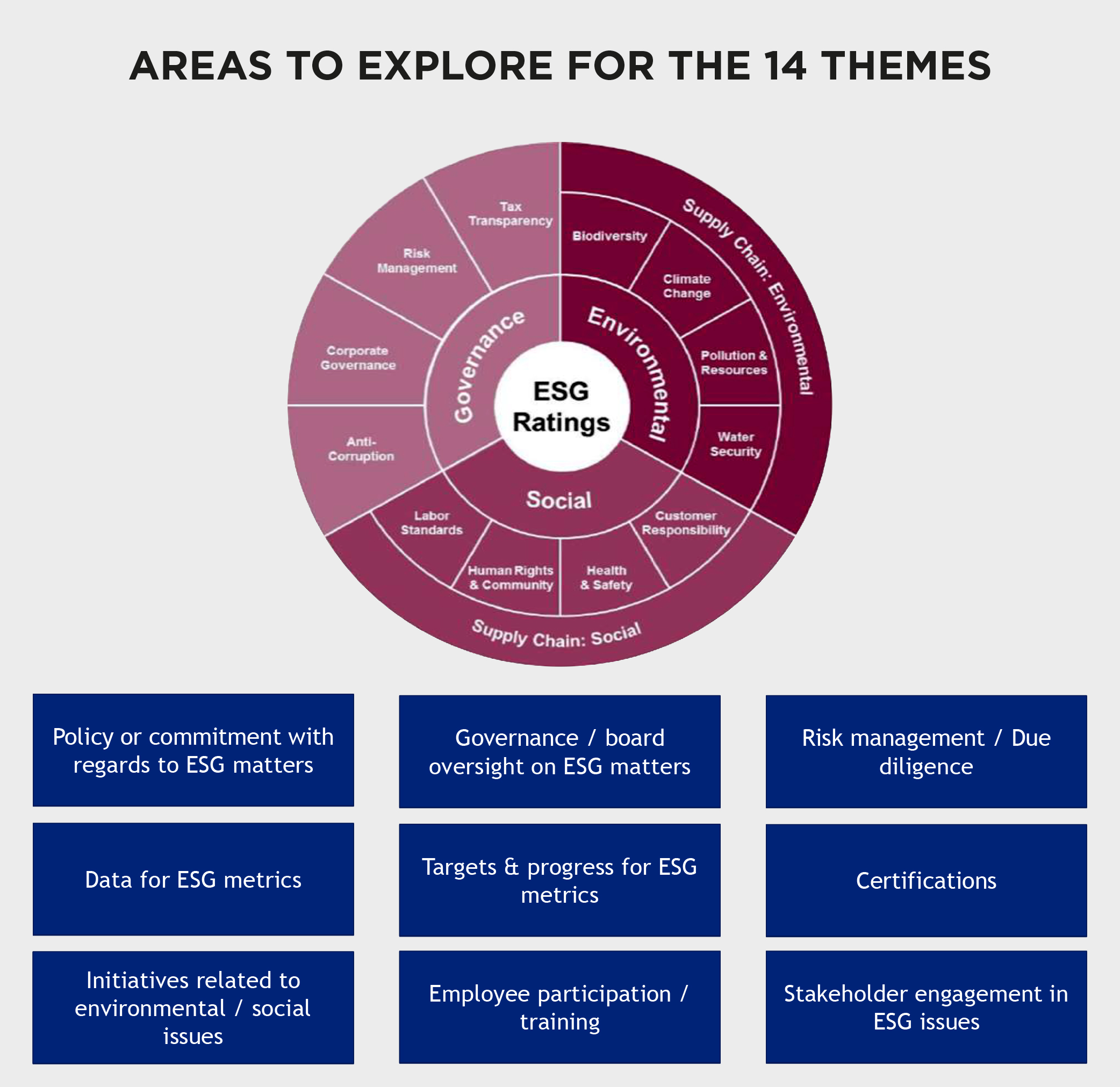

She added: One key aspect of the FTSE4Good ESG Rating is its emphasis on transparency. Companies are required to disclose relevant information regarding their ESG practices, allowing investors to make informed decisions based on a company’s commitment to responsible business conduct. This transparency fosters trust between investors and companies, aligning interests and promoting long-term sustainable growth. Covering 14 areas of themes, the ESG Ratings explore the policy and commitment regarding ESG matters and several more.

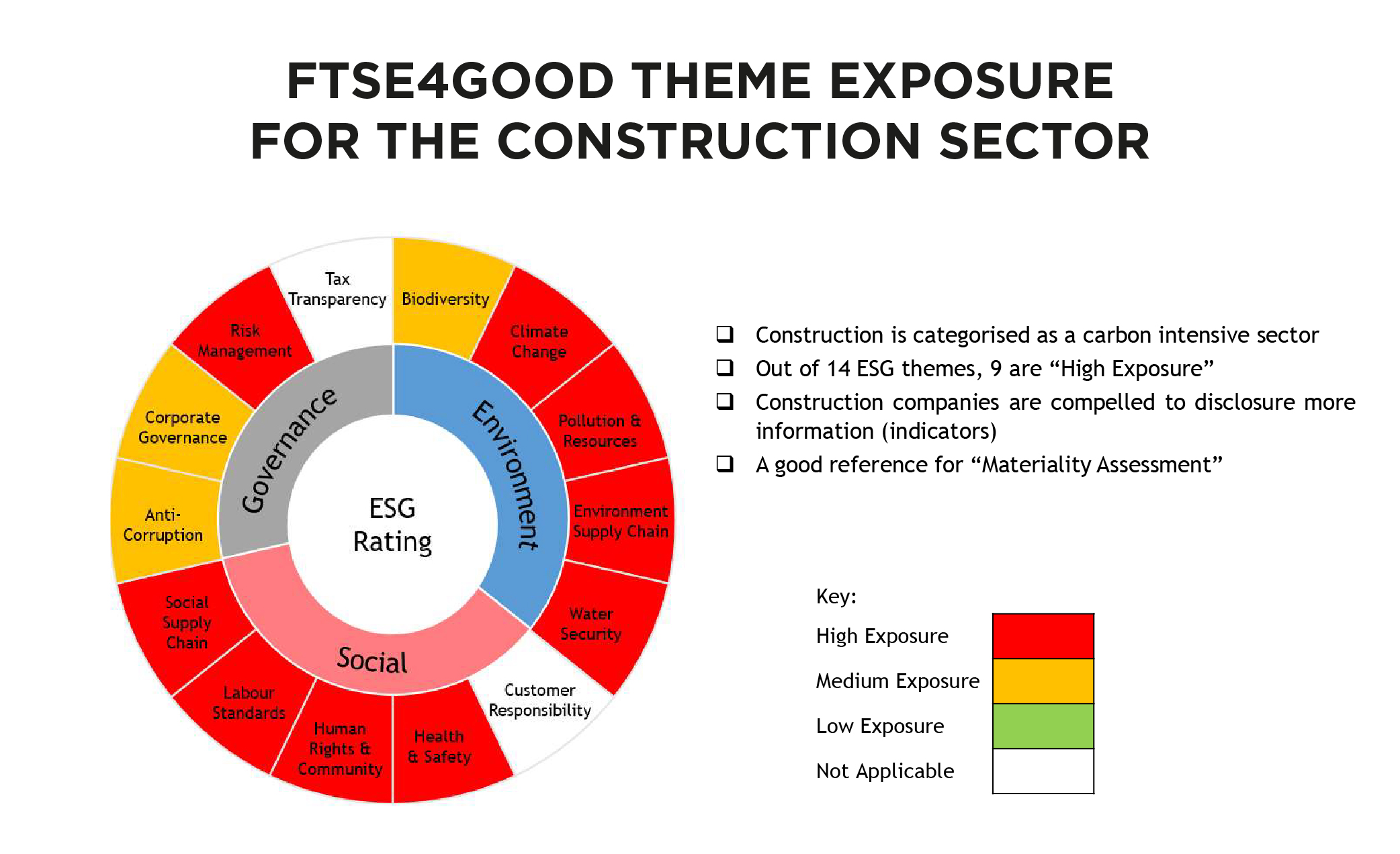

Furthermore, its’ effort towards sustainability is evident through the incorporation of this index into operations. The assessment considers various criteria, including carbon emissions, human rights, labour standards, and anti-corruption measures.

The FTSE4Good ESG Rating by Bursa Malaysia plays a pivotal role in positively influencing the construction industry in Malaysia by encouraging sustainable and responsible practices, as well as streamlining reporting among companies, as much as possible. Through this rating system, the construction industry can benefit in many ways.

Considering a company’s environmental impact, the FTSE4Good ESG Rating also includes the carbon footprint and resource management. This encourages construction firms to adopt eco-friendly construction methods, implement energy-efficient technologies, and adhere to sustainable building standards, contributing to the reduction of environmental degradation.

Companies in the construction industry with favourable FTSE4Good ESG Ratings are more likely to attract responsible investors. As sustainability becomes a key consideration for investment decisions, construction firms can access capital from investors who prioritise environmentally and socially conscious projects. This opens up opportunities for funding sustainable infrastructure projects and green building initiatives.

In essence, the FTSE4Good ESG Rating by Bursa Malaysia serves as a catalyst for positive change in the construction industry by promoting sustainable practices, fostering social responsibility, and ensuring good governance. As companies in the sector align with these criteria, they contribute to a more sustainable future and position themselves as leaders in responsible and ethical construction practices.